Tax Deadline 2024 Irs

The due date for filing your tax return is typically april 15 if you’re a calendar year filer. Third estimated tax payment for 2024 due.

The last day to file a tax return with the irs is monday, april 15 for the vast majority of americans. As of january 29, the irs is accepting and processing tax returns for 2023.

Extended Deadline To File 2023 Tax Return.

2 irs, “2024 tax filing season starts as irs begins accepting tax returns today;

The Last Day To File A Tax Return With The Irs Is Monday, April 15 For The Vast Majority Of Americans.

The due date for filing your tax return is typically april 15 if you’re a calendar year filer.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule When To Expect Your Tax Refund, The fourth month after your fiscal year ends, day 15. Irs delivers strong 2024 tax filing season;

Source: marnaqkaitlyn.pages.dev

Source: marnaqkaitlyn.pages.dev

Important Tax Dates 2024 Fred Joscelin, If you've waited till the last second, the deadline to file federal tax returns for most taxpayers is monday, april 15, 2024. For 2024, the irs specifies that taxpayers should pay at least 90 percent of the tax owed on their 2024 return, or at a minimum 100 percent of the tax shown on their 2023 tax return. uncommon.

Source: stevanawtyne.pages.dev

Source: stevanawtyne.pages.dev

Irs Tax Filing Deadline 2024 Willa Junina, Access the calendar online from your mobile device or desktop. For 2024, the irs specifies that taxpayers should pay at least 90 percent of the tax owed on their 2024 return, or at a minimum 100 percent of the tax shown on their 2023 tax return. uncommon.

Source: louisettewcarina.pages.dev

Source: louisettewcarina.pages.dev

Irs Estimated Tax Payment Dates 2024 Darcy Melodie, (the first quarterly estimated tax deadline for 2024 was on april 15.) Irs begins processing 2023 tax returns.

Source: anestassiawdorene.pages.dev

Source: anestassiawdorene.pages.dev

Irs Tax Filing Extension Deadline 2024 Casie Carlynn, The irs begins accepting tax year 2023 returns on jan. The table below shows the payment deadlines for 2024.

Source: blog.mozilla.com.tw

Source: blog.mozilla.com.tw

Tax Calendar 2024, Tax day was monday, april 15, 2024, but some exceptions exist. For the first time since 2019, april 15 is tax day — the deadline to file federal income tax returns and extensions to the internal revenue service — for most of the country.

Source: gussiqolympia.pages.dev

Source: gussiqolympia.pages.dev

What Time Is The Deadline For Taxes 2024 Hanny Kirstin, Generally, most individuals are calendar year filers. For individuals, the last day to file your 2023 taxes without an extension is april 15, 2024, unless extended because of a state holiday.

.png?format=1500w) Source: www.ascendllc.co

Source: www.ascendllc.co

2024 Tax Deadlines — Ascend Consulting, The penalty for filing late is around five percent per month, and the fee associated with paying late “is normally 0.5% per month, both of which max out at 25%.”. For 2024, the irs specifies that taxpayers should pay at least 90 percent of the tax owed on their 2024 return, or at a minimum 100 percent of the tax shown on their 2023 tax return. uncommon.

Source: www.alamy.com

Source: www.alamy.com

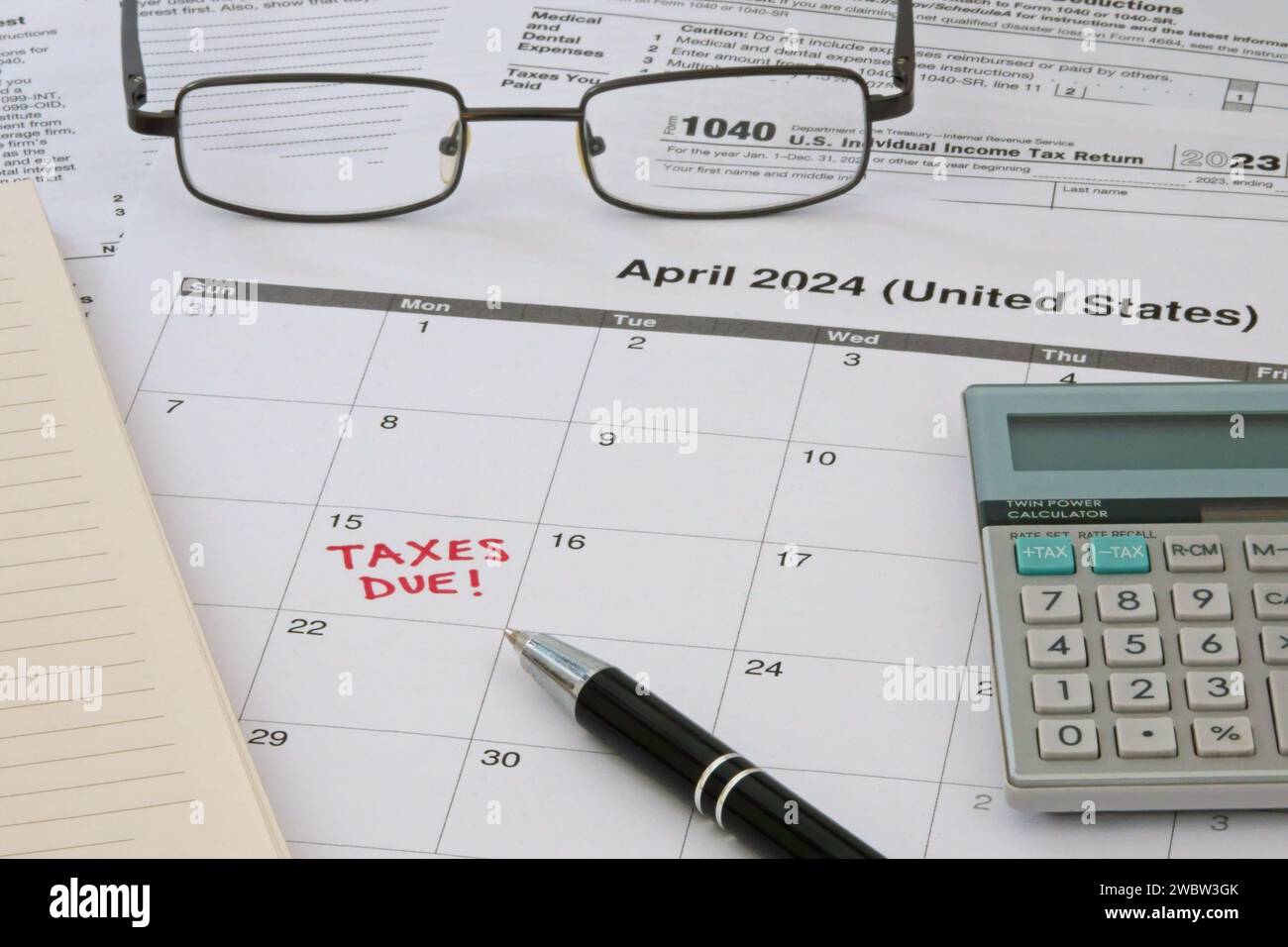

A 2024 calendar noting the April 15 USA Internal Revenue Service IRS, Second estimated tax payment for 2024 due. The irs is reminding taxpayers who need to make estimated tax payments that the 2024 second quarter estimated tax deadline is june 17.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, The irs reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is monday, april 15, 2024. The due date for filing your tax return is typically april 15 if you’re a calendar year filer.

The Last Day To File A Tax Return With The Irs Is Monday, April 15 For The Vast Majority Of Americans.

For most taxpayers, the deadline to file their personal federal tax return, pay any tax owed or request an extension to file is monday, april 15, 2024.

Washington — With The April Tax Filing Deadline Here, The Internal Revenue Service Highlighted A Variety Of Improvements That Dramatically Expanded Service For.

For individuals, the last day to file your 2023 taxes without an extension is april 15, 2024, unless extended because of a state holiday.

Posted in 2024